Our Services

- Home

- Our Services

STARTUP

Startup India Registration

Startup India is an initiative by the Government of India aimed at fostering entrepreneurship and promoting innovation.

Udyam Registration

Udyam Registration is a government registration process introduced for micro, small, and medium enterprises (MSMEs) in India.

Partnership Firm

A partnership firm is a type of business structure where two or more individuals come together to carry out a business with a shared goal of profit.

One Person Company

OPC is a type of company structure that allows a single individual to operate and manage a corporate entity.

Private Limited Company

A Private Limited Company is a privately held business entity with limited liability.

Limited Liability Partnership

LLP is a hybrid form of business structure that combines the features of a partnership and a corporation.

Section 8 Company

A Section 8 Company, or not-for-profit organization, promotes charitable objectives like education, art, commerce, science, sports, social welfare, and religion.

Nidhi Company

Nidhi Company is a type of non-banking financial institution (NBFC) recognized under the Companies Act, 2013.

Import Export Code

A unique 10-digit code issued by the Directorate General of Foreign Trade, required for businesses involved in importing or exporting goods and services from India.

FSSAI Registration

Registration with the Food Safety and Standards Authority of India (FSSAI) is mandatory for businesses involved in the manufacture, distribution, and sale of food products.

TRADEMARK

Trademark Registration

Trademark registration protects brands and logos from being copied or used without permission.

Trademark Objection

a formal challenge to your application by the Trademark Office, often due to conflicts or legal compliance issues.

Trademark Opposition

it is a legal proceeding where third parties oppose registration of a trademark, reasons such as similarity to their own marks in the market.

Trademark Renewal

Trademark renewal is the process of extending the validity of a registered trademark by submitting the required documents and fees to the relevant trademark office.

Copyright Registration

Copyright registration provides legal protection to original literary, artistic, musical, or dramatic works.

Patent Registration

Patent registration protects inventions and innovations by granting exclusive rights to the inventor for a specified period.

Provisional Patent

A provisional patent is a temporary application filed with the patent office to establish an early filing date and allows the term 'Patent Pending' to be used

GOODS AND SERVICE TAX

GST Registration

Regular filing of GST returns is mandatory for businesses registered under GST to report their sales, purchases, and tax liability to the government.

GST Return Filing

Regular filing of GST returns is mandatory for businesses registered under GST to report their sales, purchases, and tax liability to the government.

GST Registration Cancellation

Businesses can apply for cancellation of their GST registration if they cease operations or no longer meet the registration requirements.

GST Annual Return

GST annual return is a comprehensive summary of a taxpayer's transactions and tax liability over the financial year, submitted to tax authorities for compliance with Goods and Services Tax regulations.

GST E-Invoicing

GST e-invoicing is a digital invoicing system mandated by the Indian government for businesses to generate and authenticate invoices electronically under the Goods and Services Tax regime.

GST Audit

GST audit is an examination conducted by tax authorities to verify the compliance of a business's GST returns and financial records with the prevailing GST laws and regulations, ensuring transparency and legal conformity.

INCOME TAX

Personal Return Filing

Personal return filing refers to the process where individuals submit their income and financial details to tax authorities for assessment and compliance with income tax regulations.

Business Return Filing

Business return filing is the submission of financial and tax-related information by companies or business entities to tax authorities for assessment and compliance with corporate tax regulations

Tax Notices

A tax notice is an official communication from tax authorities to individuals or businesses, typically regarding discrepancies, inquiries, or requests for further information related to tax filings or payments

TDS Filing

Tax Deducted at Source (TDS) is deducted by businesses or individuals while making certain payments and is required to be deposited with the government and reported through TDS filings.

FORM 16

"Income Tax Form 16 is a certificate issued by employers to employees, detailing the salary earned, taxes deducted, and other relevant information for filing income tax returns.

Payroll Processing

Payroll processing involves the administration of employee salaries, benefits, deductions, and taxes by employers, ensuring accurate and timely compensation in compliance with regulations.

COMPLIANCES

Partnership Compliances

Partnership firms need to comply with various legal and regulatory requirements such as maintaining books of accounts, filing income tax returns, and adhering to partnership deed provisions.

LLP Compliances

Limited Liability Partnerships (LLPs) have specific requirements, including filing annual returns, maintaining registers, ensuring adherence to LLP agreement terms, conducting regular audits, and fulfilling regulatory obligations and adhering to LLP agreement terms.

Private Limited Company Compliances

Private Limited Companies need to comply with statutory requirements such as conducting board meetings, filing annual financial statements, and maintaining proper corporate governance practices.

Changes in Director

Change in directors in compliance involves updating corporate records, notifying regulatory authorities about changes in company leadership, ensuring legal adherence, and facilitating smooth transitions.

Change Name Of Company

Change in the name of the company requires legal procedures to update corporate documents and notify relevant authorities about the modification, ensuring compliance and official recognition of the new name.

Change in Register Office

Change in registered office necessitates legal formalities to update corporate records and notify regulatory bodies about the relocation, ensuring compliance and official recognition of the new office address.

Shares Transfer

Share transfer involves the legal process of transferring ownership of shares from one shareholder to another, typically requiring documentation and compliance with regulatory requirements.

Increase in Authorize Capital

Increase in authorized capital entails the legal procedure to amend a company's memorandum of association, allowing it to issue more shares than previously permitted, typically requiring regulatory filings and approvals.

DIN 3 KYC

Director Identification Number (DIN) KYC entails verifying and updating directors' personal and professional details with the Ministry of Corporate Affairs, ensuring accuracy and compliance with regulations.

Winding Up of Company

Winding up of a company involves the process of closing down its operations, liquidating assets, paying off creditors, and distributing remaining funds to shareholders.

Winding Up Of LLP

The winding up of an LLP involves settling debts, liquidating assets, distributing surplus among partners, and applying for dissolution with the Registrar of Companies.

AGREEMENTS

GIFT DEED

A gift deed is a legal document used to transfer ownership of assets voluntarily from one person (the donor) to another (the done) without the exchange of money, typically requiring legal formalities and registration.

SALE DEED

A sale deed is a legal document that transfers ownership of property from the seller to the buyer in exchange for a specified amount of money, outlining the terms and conditions of the sale and typically requiring registration.

WILL

A will is a legal document that specifies how a person's assets and properties should be distributed after their death, outlining beneficiaries and executors, and typically requiring legal formalities, signatures, testamentary instructions, and probate proceedings.

MEMORANDUM OF UNDERSTANDING

A Memorandum of Understanding (MoU) is a formal agreement between two or more parties outlining their intentions to cooperate on a specific project or goal, typically outlining terms, conditions, and objectives.

FRANCHISEE AGREEMENT

A franchisee agreement is a legal contract between a franchisor and a franchisee, outlining the terms and conditions under which the franchisee can operate the franchisor's business, including rights, obligations, and financial arrangements.

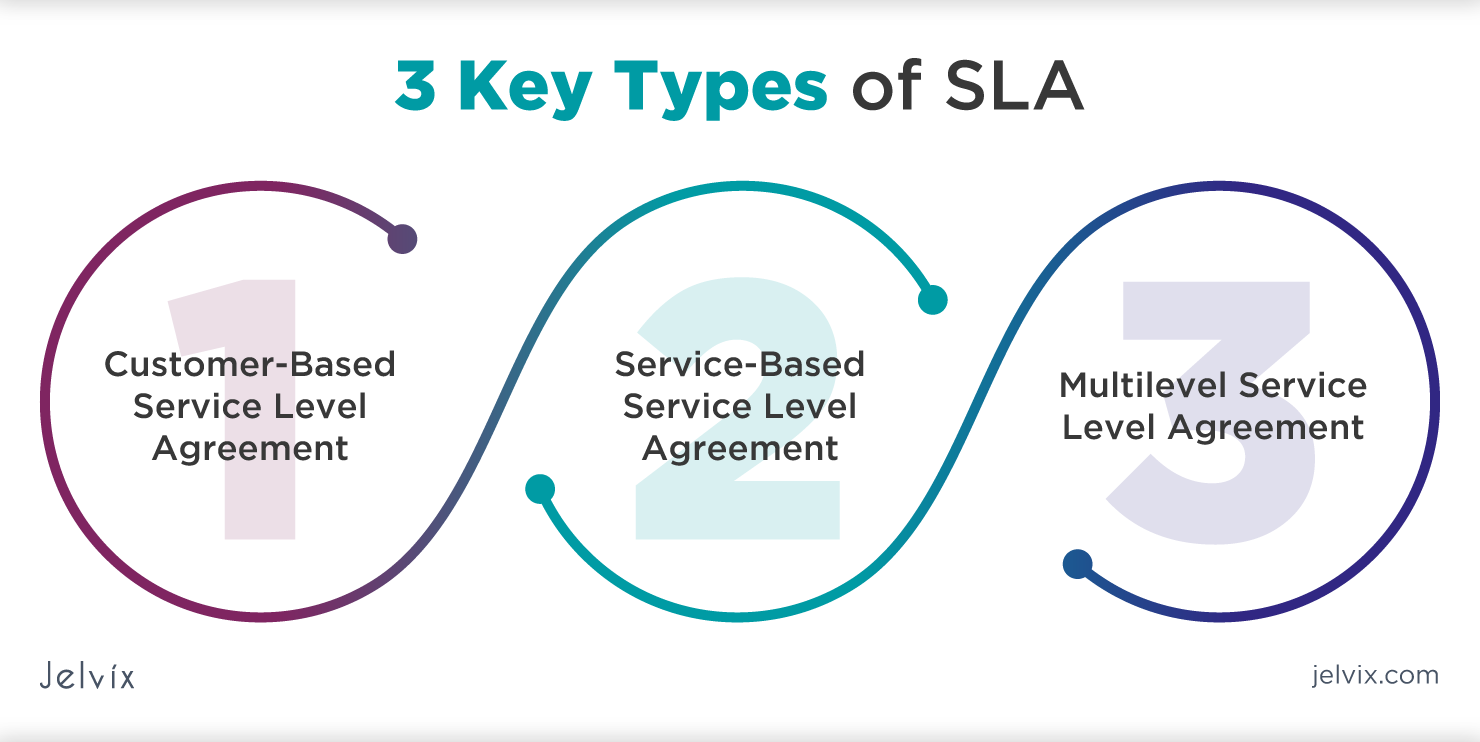

SERVICE LEVEL AGREEMENT

A Service Level Agreement (SLA) is a formal contract between a service provider and a client, specifying the level of service to be provided, including performance metrics, responsibilities, and remedies for breaches.

EMPLYEMENT CONTRACT

Employment contract is a legal agreement between an employer and an employee, outlining terms and conditions of employment, including roles, responsibilities, compensation, benefits, termination clauses.

VENDOR AGREEMENT

A vendor agreement is a legal binding contract between a vendor (seller) and a customer delineates, outlining terms and conditions for the sale or provision of goods or services, including pricing, delivery terms, and warranties.

CONSULTANCY AGREEMENT

A consultancy agreement is a legal contract between a consultant or consulting firm and a client, specifying the scope of work, deliverables, fees, confidentiality terms, and other relevant provisions.